Your Can i buy home with 640 credit score images are available. Can i buy home with 640 credit score are a topic that is being searched for and liked by netizens now. You can Get the Can i buy home with 640 credit score files here. Find and Download all free photos and vectors.

If you’re looking for can i buy home with 640 credit score pictures information connected with to the can i buy home with 640 credit score interest, you have pay a visit to the right blog. Our site always gives you suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more informative video articles and images that match your interests.

Can I Buy Home With 640 Credit Score. If your score is below 620 to 640. Minimum credit score required. Yes in fact many down payment assistance programs are available to borrowers with a 640 credit score. A minimum of 580 is needed to make the minimum down payment of 35.

Credit Score Below 640 Home Loan Programs Available Nationwide Business Loans Apply For A Loan Loan Application From pinterest.com

Credit Score Below 640 Home Loan Programs Available Nationwide Business Loans Apply For A Loan Loan Application From pinterest.com

Individuals with a credit score between 580 and 669 are said to have fair credit. According to Ellie Mae the average FICO score for home buyers with FHA loans was 680 for. 640 credit score mortgage rate. Conventional Loan Minimum Credit Score Provided By Fannie Mae. You shouldnt take on debt you dont need but prudent borrowing including a combination of revolving credit and installment debt can be beneficial to your credit score. A minimum of 580 is needed to make the minimum down payment of 35.

Among consumers with FICO credit scores of 640 the average utilization rate is 679.

If your score is below 620 to 640. Keep in mind that your credit card options wont change much by a few credit score points so if you have a 642 644 646 or 648 credit score you will qualify for the same cards as if you had a 641 643 645 or 647 credit card credit score. Conventional Loan Minimum Credit Score Provided By Fannie Mae. As yall know I purchased my first home in 2017 and going through the process to work with my credit score and improve it was eye opening. Consider the following example from Credit Sesame. If youre planning on buying a home and you have bad credit.

Source: pinterest.com

Source: pinterest.com

But it should also be noted that the credit score required to get approved for. According to Ellie Mae the average FICO score for home buyers with FHA loans was 680 for. 640 credit score mortgage rate. Credit Score Requirements For a Mortgage in 2021. That said lenders can impose their own credit minimums for FHA loans.

Source: pinterest.com

Source: pinterest.com

Learn more about your credit score. A 640 FICO credit score is considered to be below averageWith a credit score of 640 you have reached the fair range of credit score. But it should also be noted that the credit score required to get approved for. But you will always pay more if you represent higher risk. Yes you can buy a house with a 600 credit score Mortgage rules tightened after the housing crisis making it tough to buy a home with low credit.

Source: pinterest.com

Source: pinterest.com

Todays guest feature will help you. A minimum of 580 is needed to make the minimum down payment of 35. A credit score is a three-digit number that is arrived at after your credit report has. As yall know I purchased my first home in 2017 and going through the process to work with my credit score and improve it was eye opening. These minimums are flexible if for example you have a sizable down payment.

Source: pinterest.com

Source: pinterest.com

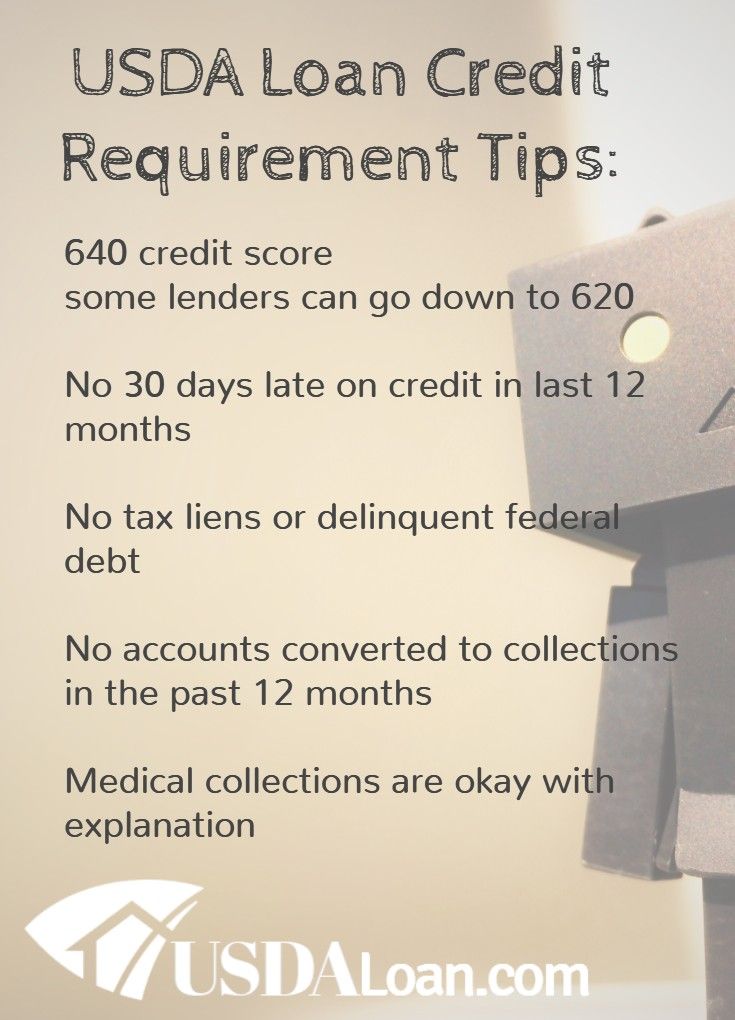

None officially though most lenders prefer 640 A USDA loan is insured by the US. Consider applying for an FHA loan which you can get with a credit score as low as 500though to get approved with a score below 580 youll need a 10 down payment. Make sure you have a large down payment plus a good amount of cash reserves beyond that. Most conventional loans require a minimum credit score of 620 and a score above 640 is recommended for USDA loans. Conventional Loan Minimum Credit Score Provided By Fannie Mae.

Source: pinterest.com

Source: pinterest.com

If youre buying a home soon now is the time to get acquainted with your credit score and find tools to make the most of it. According to Ellie Mae the average FICO score for home buyers with FHA loans was 680 for. If your score is below 620 to 640. Todays guest feature will help you. An FHA Federal Housing Administration home loan is your best option because most lenders wont approve a conventional loan for borrowers with a credit score.

Source: pinterest.com

Source: pinterest.com

Credit Score Requirements For a Mortgage in 2021. FHA Loan Lowest Credit Score Requirements. Consider the following example from Credit Sesame. Among consumers with FICO credit scores of 640 the average utilization rate is 679. A 640 FICO credit score is considered to be below averageWith a credit score of 640 you have reached the fair range of credit score.

Source: pl.pinterest.com

Source: pl.pinterest.com

Work on paying down other debts to reduce your DTI. Minimum credit score required. That said lenders can impose their own credit minimums for FHA loans. A minimum of 580 is needed to make the minimum down payment of 35. Make sure you have a large down payment plus a good amount of cash reserves beyond that.

Source: fi.pinterest.com

Source: fi.pinterest.com

The Federal Housing Administration or FHA requires a credit score of at least 500 to buy a home with an FHA loan. Yes in fact many down payment assistance programs are available to borrowers with a 640 credit score. An FHA Federal Housing Administration home loan is your best option because most lenders wont approve a conventional loan for borrowers with a credit score. A mortgage lender can help you see if you qualify for down payment assistance. The types of programs that exist include both local city county or state level and nationwide programs.

I say technically because in reality it will be. As yall know I purchased my first home in 2017 and going through the process to work with my credit score and improve it was eye opening. Among consumers with FICO credit scores of 640 the average utilization rate is 679. 640 credit score mortgage rate. You shouldnt take on debt you dont need but prudent borrowing including a combination of revolving credit and installment debt can be beneficial to your credit score.

Source: pinterest.com

Source: pinterest.com

Most conventional loans require a minimum credit score of 620 and a score above 640 is recommended for USDA loans. Try to establish a solid credit mix. Even if you could get approved for a loan youd pay a high interest rate. If youre buying a home soon now is the time to get acquainted with your credit score and find tools to make the most of it. An FHA Federal Housing Administration home loan is your best option because most lenders wont approve a conventional loan for borrowers with a credit score.

Source: pinterest.com

Source: pinterest.com

These minimums are flexible if for example you have a sizable down payment. Work on paying down other debts to reduce your DTI. Conventional Adjustable-rate mortgages ARMs require a minimum credit score of 640 with a 75 loan to value ratio. However many lenders require a score of 620 to 640 to qualify. I say technically because in reality it will be.

Source: pinterest.com

Source: pinterest.com

Try to establish a solid credit mix. Try to establish a solid credit mix. A 640 FICO credit score is considered to be below averageWith a credit score of 640 you have reached the fair range of credit score. But you will always pay more if you represent higher risk. Most conventional loans require a minimum credit score of 620 and a score above 640 is recommended for USDA loans.

Source: in.pinterest.com

Source: in.pinterest.com

If youre planning on buying a home and you have bad credit. Technically you can qualify for an FHA home loan with a credit score between 500 - 579 and a 10 down payment. If youre buying a home soon now is the time to get acquainted with your credit score and find tools to make the most of it. Among consumers with FICO credit scores of 640 the average utilization rate is 679. According to Ellie Mae the average FICO score for home buyers with FHA loans was 680 for.

Source: pinterest.com

Source: pinterest.com

A mortgage lender can help you see if you qualify for down payment assistance. These minimums are flexible if for example you have a sizable down payment. Consider applying for an FHA loan which you can get with a credit score as low as 500though to get approved with a score below 580 youll need a 10 down payment. Technically you can qualify for an FHA home loan with a credit score between 500 - 579 and a 10 down payment. Even if you could get approved for a loan youd pay a high interest rate.

Source: pinterest.com

Source: pinterest.com

A mortgage lender can help you see if you qualify for down payment assistance. If youre buying a home soon now is the time to get acquainted with your credit score and find tools to make the most of it. If youre planning on buying a home and you have bad credit. Learn more about your credit score. Most conventional loans require a minimum credit score of 620 and a score above 640 is recommended for USDA loans.

Source: br.pinterest.com

Source: br.pinterest.com

Most conventional loans require a minimum credit score of 620 and a score above 640 is recommended for USDA loans. Among consumers with FICO credit scores of 640 the average utilization rate is 679. A lender will be able to give you a customized mortgage quote given your situation. A minimum of 580 is needed to make the minimum down payment of 35. 640 credit score mortgage rate.

Source: pinterest.com

Source: pinterest.com

The Federal Housing Administration or FHA requires a credit score of at least 500 to buy a home with an FHA loan. Conventional Loan Minimum Credit Score Provided By Fannie Mae. A lender will be able to give you a customized mortgage quote given your situation. If your score is below 620 to 640. Conventional Adjustable-rate mortgages ARMs require a minimum credit score of 640 with a 75 loan to value ratio.

Source: pinterest.com

Source: pinterest.com

But you will always pay more if you represent higher risk. You shouldnt take on debt you dont need but prudent borrowing including a combination of revolving credit and installment debt can be beneficial to your credit score. Among consumers with FICO credit scores of 640 the average utilization rate is 679. If youre planning on buying a home and you have bad credit. Make sure you have a large down payment plus a good amount of cash reserves beyond that.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can i buy home with 640 credit score by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.