Your Can u buy home with 600 credit score images are available in this site. Can u buy home with 600 credit score are a topic that is being searched for and liked by netizens now. You can Download the Can u buy home with 600 credit score files here. Download all royalty-free vectors.

If you’re looking for can u buy home with 600 credit score images information connected with to the can u buy home with 600 credit score keyword, you have visit the ideal blog. Our website frequently provides you with hints for viewing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

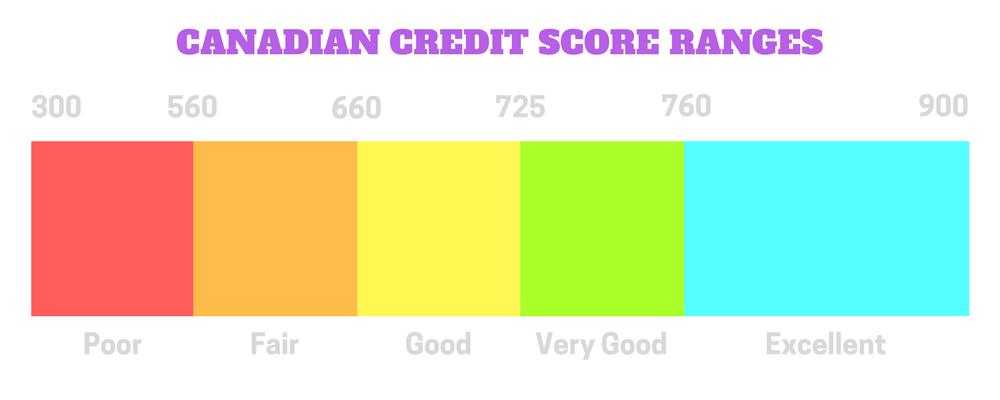

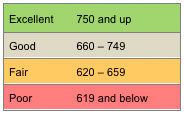

Can U Buy Home With 600 Credit Score. Is 660 a good credit score. A good credit score in the United States ranges between 690 and 720. Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages. Is 740 a good credit score.

Did You Know These Differences Between Credit Unions And Banks Give Ttcu A Call At 615 244 1910 O Credit Unions Vs Banks Credit Repair Credit Union Marketing From pinterest.com

Did You Know These Differences Between Credit Unions And Banks Give Ttcu A Call At 615 244 1910 O Credit Unions Vs Banks Credit Repair Credit Union Marketing From pinterest.com

It comes with some complications. Mortgage loans for borrowers with credit scores under 600 require a 35 down payment. FHA loans are available to borrowers with a credit score of 580 or higher. FHA loans are intended. If you have a 600 credit score you should be in an excellent position to qualify. One of such complication is that you dont have access to the best mortgage loans available such as the conventional one which comes with easier steps and procedure in.

However many lenders require a score of 620 to 640 to qualify.

FHA does not require borrowers to pay off outstanding collections and charge-offs to qualify for FHA Loans. They suffer a lot due to this. In addition to that itll also determine the interest youll be charged on a loan. Mortgage loans for borrowers with credit scores under 600 require a 35 down payment. Can I get a home loan with a credit score of 600. FHA home loan These are government loans insured by the Federal Housing Administration FHA.

Source: forbes.com

Source: forbes.com

Poor credit under 580. Can You Get Home Loan 600 Credit Score Low Credit Score Mortgage Lenders. The minimum credit score needed to get an FHA loan is usually around 580. A score of 600 will give you a fair chance of home loan approval. Is 660 a good credit score.

Source: credit.org

Source: credit.org

Even if you have low credit there are still options for buying a home. Low credit score but still looking for a home. How much money do I need to put down with bad credit. The better your credit score the higher your chances of getting approved. Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages.

Source: pinterest.com

Source: pinterest.com

A score of 600 will give you a fair chance of home loan approval. Is 740 a good credit score. Above that youre in the excellent category. FHA loans are intended. A good credit score in the United States ranges between 690 and 720.

Source: helpandadvice.co.uk

Source: helpandadvice.co.uk

The minimum credit score needed to get an FHA loan is usually around 580. A minimum of 580 is needed to make the minimum down payment of 35. However for those interested in applying for an FHA loan applicants are only required to have a minimum FICO score of 500 to qualify for a down payment around 10. VA home loan VA home loans dont have a minimum credit score requirement so its possible to get this. The minimum credit score needed to get an FHA loan is usually around 580.

Source: cardrates.com

Source: cardrates.com

Scores below 600 would be considered high to very high risk. Can You Get Home Loan 600 Credit Score Low Credit Score Mortgage Lenders. The lowest credit score accepted by FHA is 500 with a 10 down payment. However the minimum credit score requirements vary based on. Here are some ways you can still obtain a home with a low credit score.

Source: badcredit.org

Source: badcredit.org

However for those interested in applying for an FHA loan applicants are only required to have a minimum FICO score of 500 to qualify for a down payment around 10. Those with a credit score of 580 can qualify for a down payment as low as 35. A score of 670 is considered an excellent credit score significantly boosting your chances of home loan approval. Fair credit 580 to 670. Is 740 a good credit score.

Source: pinterest.com

Source: pinterest.com

This holds true as long as it is not lower than a credit score of 580. Here are some ways you can still obtain a home with a low credit score. Fair credit 580 to 670. Is 720 a good credit score. FHA loans are intended.

Source: pinterest.com

Source: pinterest.com

The minimum credit score is around 620 for most conventional lenders. Buying a home doesnt always require a stellar credit score. Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages. Here are some ways you can still obtain a home with a low credit score. Is 650 a good credit score.

Source: badcredit.org

Source: badcredit.org

Above that youre in the excellent category. Fair credit 580 to 670. They suffer a lot due to this. Scores below 600 would be considered high to very high risk. Within these open-ended parameters the following answers ring true about having a good credit score to buy a house.

Source: credible.com

Source: credible.com

In order to receive home loan as the best interest is very difficult task because it required a good credit score. How much money do I need to put down with bad credit. The better your credit score the higher your chances of getting approved. Programs for borrowers buying a house with a 600 credit score include. In addition to that itll also determine the interest youll be charged on a loan.

Here are some ways you can still obtain a home with a low credit score. Although this may vary according to which bank you use. Can You Get Home Loan 600 Credit Score Low Credit Score Mortgage Lenders. How much money do I need to put down with bad credit. A lender will be able to give you a customized mortgage quote given your situation.

Source: loanscanada.ca

Source: loanscanada.ca

A score of 670 is considered an excellent credit score significantly boosting your chances of home loan approval. However many lenders require a score of 620 to 640 to qualify. Is 650 a good credit score. Can You Get Home Loan 600 Credit Score Low Credit Score Mortgage Lenders. The lowest credit score accepted by FHA is 500 with a 10 down payment.

Source: nl.pinterest.com

Source: nl.pinterest.com

The lowest credit score accepted by FHA is 500 with a 10 down payment. If youre a first-time home buyer or havent purchased a home in the last 3 years you could qualify for this loan. Scores below 600 would be considered high to very high risk. In addition to that itll also determine the interest youll be charged on a loan. FHA loans are intended.

Source: pinterest.com

Source: pinterest.com

How much money do I need to put down with bad credit. Is 720 a good credit score. If you can make a 10 down payment you can probably get approved with a credit score between 500 579. FHA requires the lowest middle credit score borrowers to. A lender will be able to give you a customized mortgage quote given your situation.

Source: creditsesame.com

Source: creditsesame.com

FHA loans are intended. A good credit score in the United States ranges between 690 and 720. Poor credit under 580. Getting a mortgage with a 600 credit score is possible but not that easy. This holds true as long as it is not lower than a credit score of 580.

Source: pinterest.com

Source: pinterest.com

Programs for borrowers buying a house with a 600 credit score include. Prospective home buyers should aim to have credit scores of 760 or greater to qualify for the best interest rates on mortgages. In this case youll want to look at ways to. Is 660 a good credit score. Although this may vary according to which bank you use.

Source: creditsesame.com

Source: creditsesame.com

Although this may vary according to which bank you use. Is 630 a good credit score. Credit scores above 700 are usually considered unique and exemplary. However for those interested in applying for an FHA loan applicants are only required to have a minimum FICO score of 500 to qualify for a down payment around 10. Among other qualification requirements mortgages will have credit score requirements.

Source: gocleancredit.com

Source: gocleancredit.com

The minimum credit score youll need depends on the loan type. Scores below 600 would be considered high to very high risk. A lender will be able to give you a customized mortgage quote given your situation. However for those interested in applying for an FHA loan applicants are only required to have a minimum FICO score of 500 to qualify for a down payment around 10. However many lenders require a score of 620 to 640 to qualify.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title can u buy home with 600 credit score by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.