Your Can you claim mobile home on your taxes images are ready in this website. Can you claim mobile home on your taxes are a topic that is being searched for and liked by netizens today. You can Find and Download the Can you claim mobile home on your taxes files here. Download all royalty-free photos and vectors.

If you’re looking for can you claim mobile home on your taxes pictures information linked to the can you claim mobile home on your taxes interest, you have pay a visit to the ideal site. Our site always gives you hints for viewing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and images that match your interests.

Can You Claim Mobile Home On Your Taxes. KathieC As Carl said - that is not deductible. You can deduct those expenses off your tax return this year. However the answer must go deeper as things are slightly more complicated than that. Whether your mobile home is real or personal property you can deduct property taxes.

4 Tips To Help Notaries Protect Themselves From Tax Id Theft Tax Season Notary Fast Track From pinterest.com

4 Tips To Help Notaries Protect Themselves From Tax Id Theft Tax Season Notary Fast Track From pinterest.com

Likewise if you rent a mobile home lot there will be certain deductions available to you that the actual owners of the lot cannot claim. In most states you can expect to pay around 200-300 per month. Whether your mobile home is real or personal property you can deduct property taxes. To qualify the taxes must be based on the value of the home and the taxes must be assessed to all property owners. You can deduct those expenses off your tax return this year. If youre a teacher you can claim unreimbursed expenses for PPE purchases made after March 12 2020 as an Educator Expense Deduction.

This is a deduction you can take without having to itemize your taxes so you dont have to.

You can only claim the business portion of the expenses if the mobile devices are used for both business and private uses. To qualify the mobile home must be your main home and you must own and live in the home for a total of two. But dont worry well break it down. If your mobile phone cost under 300 you can claim a one-off immediate tax deduction. If you own the land on which your mobile home is situated you can deduct property taxes. If youre a teacher you can claim unreimbursed expenses for PPE purchases made after March 12 2020 as an Educator Expense Deduction.

Source: pinterest.com

Source: pinterest.com

Armed Forces and you had to move because of a permanent change of station. If your mobile phone cost under 300 you can claim a one-off immediate tax deduction. While youre itemizing your deductions you can also write off any property tax you pay on your mobile home. If its fixed to the ground youll claim the expense as a real estate tax on line 6 of. You can write off the part you pay at closing in the year you.

Source: pinterest.com

Source: pinterest.com

If you use your home to conduct your work you can claim a proportion of all your household bills gas electricity water and council tax against your bill. To qualify the mobile home must be your main home and you must own and live in the home for a total of two. You may also qualify for mobile home park depreciation in some situations if so it might be worth your time to learn more about utility trailer depreciation rates. To qualify the taxes must be based on the value of the home and the taxes must be assessed to all property owners. You can write off the part you pay at closing in the year you.

Source: pinterest.com

Source: pinterest.com

To deduct property tax on a Federal tax return your name must be on the title of the property. Regardless of what loopholes you try to find yes mobile home owners do pay property taxes. The seller may foot you with part of the property taxes on the mobile home especially if youre buying land with it. Teachers get up to 250 of qualified expenses per year 500 if married and filing jointly if both spouses are eligible educators but not more than 250 each. In short the answer is that yes it is possible to get a tax credit for a mobile home purchase.

Source: pinterest.com

Source: pinterest.com

This is a deduction you can take without having to itemize your taxes so you dont have to. This also applies if youve purchased a PAYG mobile. If your office accounts for say 20 of. However the answer must go deeper as things are slightly more complicated than that. Travel expenses for military reserve members.

Source: pinterest.com

Source: pinterest.com

If youre filing back taxes this deduction was available to non-military members before 2018 To claim this deduction for 2020 fill out IRS Form 3903 and Schedule 1. Whether youre renting or purchasing land to build a new mobile home property you need to factor in the taxes. This will allow you to determine which charges are directly related to your cell phone and remove the charges that are related to family members. You can write off the part you pay at closing in the year you. Regardless of what loopholes you try to find yes mobile home owners do pay property taxes.

Source: pinterest.com

Source: pinterest.com

The costs incurred for business calls made using your personal mobile can be claimed as an expense. Travel expenses for military reserve members. If your mobile phone purchase and the contract is made in your name you wont be able to claim the cost of the mobile phone or the monthly tariff. Charges for improvements such as sidewalks and sewer that serve your property but not others are not eligible. If you stocked up on face masks and hand sanitizer in 2020 to combat the COVID-19 pandemic the IRS has good news.

Source: pinterest.com

Source: pinterest.com

The seller may foot you with part of the property taxes on the mobile home especially if youre buying land with it. Whether your mobile home is real or personal property you can deduct property taxes. If you use your home to conduct your work you can claim a proportion of all your household bills gas electricity water and council tax against your bill. Whether youre renting or purchasing land to build a new mobile home property you need to factor in the taxes. If your mobile phone purchase and the contract is made in your name you wont be able to claim the cost of the mobile phone or the monthly tariff.

If youre filing back taxes this deduction was available to non-military members before 2018 To claim this deduction for 2020 fill out IRS Form 3903 and Schedule 1. The Internal Revenue Code allows homeowners to exclude up to 250000 of the resulting gain from capital gains tax if certain requirements are met. While youre itemizing your deductions you can also write off any property tax you pay on your mobile home. The following will apply. Regardless of what loopholes you try to find yes mobile home owners do pay property taxes.

How do i claim the mobile home i bought on my taxes using turbo tax. Travel expenses for military reserve members. Teachers get up to 250 of qualified expenses per year 500 if married and filing jointly if both spouses are eligible educators but not more than 250 each. KathieC As Carl said - that is not deductible. You may also be able to deduct the interest on your manufactured home loan if the home is used for other deductible purposes eg.

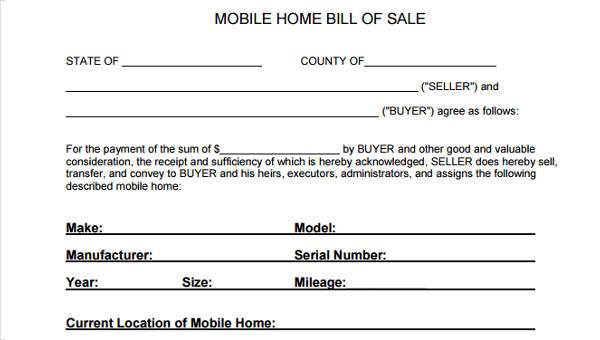

Source: sampleforms.com

Source: sampleforms.com

If your mobile phone purchase and the contract is made in your name you wont be able to claim the cost of the mobile phone or the monthly tariff. This is a deduction you can take without having to itemize your taxes so you dont have to. Teachers get up to 250 of qualified expenses per year 500 if married and filing jointly if both spouses are eligible educators but not more than 250 each. Likewise if you rent a mobile home lot there will be certain deductions available to you that the actual owners of the lot cannot claim. Additionally how much does it cost to live in a mobile home park.

Source: co.pinterest.com

Source: co.pinterest.com

The easiest way to determine this would be to obtain an itemized version of your monthly cell phone bill. If your mobile phone cost under 300 you can claim a one-off immediate tax deduction. Florida does not have a personal income tax so there are no state income tax return deduction to enter for rent paid in FloridaRent paid is not entered on a federal tax return. If your mobile phone purchase and the contract is made in your name you wont be able to claim the cost of the mobile phone or the monthly tariff. The deduction you may be able to claim on your tax return depends on whether or not.

Source: pinterest.com

Source: pinterest.com

The manufactured home itself serves as collateral for the loan youve taken out to purchase the property. The Internal Revenue Code allows homeowners to exclude up to 250000 of the resulting gain from capital gains tax if certain requirements are met. Yes you can deduct the portion of your family plan cell phone costs that is business usage. Additionally how much does it cost to live in a mobile home park. How do i claim the mobile home i bought on my taxes using turbo tax.

Source: pinterest.com

Source: pinterest.com

You can deduct moving expenses on your taxes if youre an active-duty member of the US. If your mobile phone cost under 300 you can claim a one-off immediate tax deduction. If your mobile phone purchase and the contract is made in your name you wont be able to claim the cost of the mobile phone or the monthly tariff. If your employer provides you with a phone for work use and they are billed for the usage phone calls text messages data then you cant claim a deduction. While youre itemizing your deductions you can also write off any property tax you pay on your mobile home.

The deduction you may be able to claim on your tax return depends on whether or not. For a mobile home located on land you own it is considered real property and therefore you will pay real estate tax. In short the answer is that yes it is possible to get a tax credit for a mobile home purchase. But dont worry well break it down. If its fixed to the ground youll claim the expense as a real estate tax on line 6 of.

Source: pinterest.com

Source: pinterest.com

Additionally how much does it cost to live in a mobile home park. To qualify the taxes must be based on the value of the home and the taxes must be assessed to all property owners. How do i claim the mobile home i bought on my taxes using turbo tax. KathieC As Carl said - that is not deductible. Costs you incur before work commences.

Source: in.pinterest.com

Source: in.pinterest.com

If its fixed to the ground youll claim the expense as a real estate tax on line 6 of. If youre filing back taxes this deduction was available to non-military members before 2018 To claim this deduction for 2020 fill out IRS Form 3903 and Schedule 1. If your employer provides you with a phone for work use and they are billed for the usage phone calls text messages data then you cant claim a deduction. In most states you can expect to pay around 200-300 per month. This will allow you to determine which charges are directly related to your cell phone and remove the charges that are related to family members.

Source: pinterest.com

Source: pinterest.com

The home is used as a primary or secondary residence. If your mobile phone purchase and the contract is made in your name you wont be able to claim the cost of the mobile phone or the monthly tariff. KathieC As Carl said - that is not deductible. The manufactured home itself serves as collateral for the loan youve taken out to purchase the property. In most states you can expect to pay around 200-300 per month.

Source: pinterest.com

Source: pinterest.com

However the answer must go deeper as things are slightly more complicated than that. Teachers get up to 250 of qualified expenses per year 500 if married and filing jointly if both spouses are eligible educators but not more than 250 each. Also if you prepaid points at closing for your mobile home which helps reduce your interest rate you can deduct that amount in the year you. Yes you can deduct the portion of your family plan cell phone costs that is business usage. If youre filing back taxes this deduction was available to non-military members before 2018 To claim this deduction for 2020 fill out IRS Form 3903 and Schedule 1.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title can you claim mobile home on your taxes by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.