Your Current prime rate for home equity line images are ready. Current prime rate for home equity line are a topic that is being searched for and liked by netizens today. You can Download the Current prime rate for home equity line files here. Find and Download all royalty-free vectors.

If you’re searching for current prime rate for home equity line pictures information linked to the current prime rate for home equity line topic, you have pay a visit to the right blog. Our website frequently provides you with suggestions for viewing the highest quality video and image content, please kindly hunt and find more enlightening video articles and graphics that fit your interests.

Current Prime Rate For Home Equity Line. Lenders would express that as prime plus 125. APR Annual Percentage Rate. In early 2020 for example Tangerine emerged as the most competitive SLOC lender in Canada. As a HELOC balance fluctuates with user activity and rising or falling interest rates the monthly payments may go up or down.

Home Equity Line Of Credit Heloc Santander Bank Santander Liferay Dxp From santanderbank.com

Home Equity Line Of Credit Heloc Santander Bank Santander Liferay Dxp From santanderbank.com

The offer carries an interest rate as low as. A home equity line of credit HELOC is a revolving account that lets you borrow against your home equity. Its also well below average big bank HELOC rates which are commonly priced at prime. Rates are subject to approval. If you have good credit your HELOC rate could be around 3 percent to 5 percent. Most lenders add on a margin above the prime rate.

He predicts a 461 percent average rate on home equity lines of credit HELOC for the year and a 505 percent average rate on home equity loans.

There is no fee to switch to a fixed rate but there is a fee of 1 of the original lock amount if the lock is cancelled after 45 days of the lock date. The average rate for a variable-rate home equity line of credit is 561. Home equity line of credit rates are determined by your financial situation and your credit score. 73 Zeilen The rate on a HELOC is based on a margin above or below the prime rate. This rate will never exceed 1590. You may have up to five separate locks on a single HELOC account at one time.

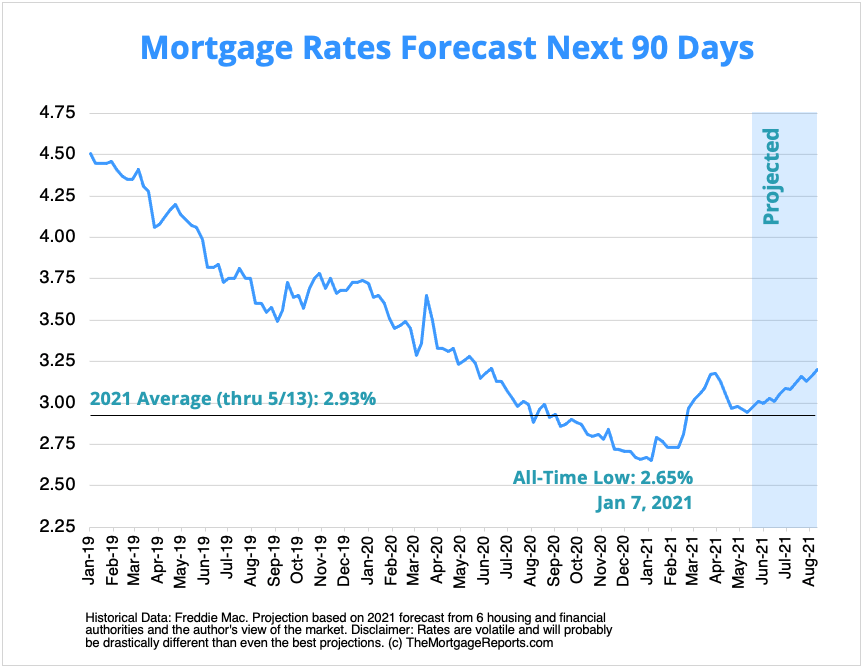

Source: themortgagereports.com

Source: themortgagereports.com

Home Equity Line of Credit Lock Feature. Again the current prime rate is 325. The data below illustrates how home equity loan rates compare to interest rates on first mortgages across the United States. He predicts a 461 percent average rate on home equity lines of credit HELOC for the year and a 505 percent average rate on home equity loans. A HELOC on the other hand is more like a credit card in that the interest rate is variable usually indexed to the Prime Rate and the borrower can access as much or as little of a given credit line over the life of the HELOC.

Source: homeequitylineof.credit

Source: homeequitylineof.credit

Home equity line of credit rates are determined by your financial situation and your credit score. Most lenders add on a margin above the prime rate. Again the current prime rate is 325. Rates are available to new accounts only and cannot be used to refinance existing ESL equity debt. Again the current prime rate is 325.

Source: erate.com

Source: erate.com

The monthly payments consist of interest only and the interest rate varies with the prime rate. ESL waives the closing costs for a home equity line of credit. HELOCs also resemble credit cards in that borrowers are only required to pay the interest thats due at the end of each statement month. Home Equity Line of Credit Lock Feature. You can switch outstanding variable interest rate balances to a fixed rate during the draw period using the Chase Fixed Rate Lock Option.

Source: bankofthewest.com

Source: bankofthewest.com

A home equity line might be advertised as having a rate of prime plus 2 That means when the prime is 5 the HELOCs rate is 7. Again the current prime rate is 325. Again the current prime rate is 325. You can switch outstanding variable interest rate balances to a fixed rate during the draw period using the Chase Fixed Rate Lock Option. This rate will never exceed 1590.

Source: interiorfcu.org

Source: interiorfcu.org

A home equity line of credit HELOC is a revolving account that lets you borrow against your home equity. The average interest rate for a 15-year fixed-rate home equity loan is currently 582. As you see in the table above the pricing of a home equity line of credit varies from lender to lender. APR Annual Percentage Rate. This rate will never exceed 1590.

Source:

Source:

73 Zeilen The rate on a HELOC is based on a margin above or below the prime rate. Rates are subject to approval. The average HELOC rate is 472. You can easily see if you qualify by providing some basic information before you formally apply for a home equity loan. There is no fee to switch to a fixed rate but there is a fee of 1 of the original lock amount if the lock is cancelled after 45 days of the lock date.

Source: servicecu.org

Source: servicecu.org

The average rate for a 30000 home equity line of credit or HELOC was 6 in December according to Bankrate. A home equity line might be advertised as having a rate of prime plus 2 That means when the prime is 5 the HELOCs rate is 7. The repayment term can be as long as 30 years. Now you still need to make sure that 105000 doesnt exceed 65 of your homes value. Rates are subject to approval.

Source: pinterest.com

Source: pinterest.com

In early 2020 for example Tangerine emerged as the most competitive SLOC lender in Canada. As a HELOC balance fluctuates with user activity and rising or falling interest rates the monthly payments may go up or down. The monthly payments consist of interest only and the interest rate varies with the prime rate. The data below illustrates how home equity loan rates compare to interest rates on first mortgages across the United States. There is no fee to switch to a fixed rate but there is a fee of 1 of the original lock amount if the lock is cancelled after 45 days of the lock date.

Source: bankrate.com

Source: bankrate.com

If youre interested in tapping your home equity youll also learn how to get the best home equity rates. Its also well below average big bank HELOC rates which are commonly priced at prime. The average interest rate for a 15-year fixed-rate home equity loan is currently 582. Most lenders add on a margin above the prime rate. To be sure simply divide the HELOC amount by the value of your home.

Source: ncb.coop

Source: ncb.coop

A HELOC on the other hand is more like a credit card in that the interest rate is variable usually indexed to the Prime Rate and the borrower can access as much or as little of a given credit line over the life of the HELOC. The interest rate on that hypothetical home equity line would have dropped from 525 to 425 when the US. Tangerine held on to the title of lowest HELOC rate through the COVID-19 lockdown with its rate dipping down to just 235 prime 010. If youre interested in tapping your home equity youll also learn how to get the best home equity rates. The offer carries an interest rate as low as.

HELOCs also resemble credit cards in that borrowers are only required to pay the interest thats due at the end of each statement month. Tangerine held on to the title of lowest HELOC rate through the COVID-19 lockdown with its rate dipping down to just 235 prime 010. You may have up to five separate locks on a single HELOC account at one time. This rate will never exceed 1590. If banks raise the prime to 525 the HELOCs rate rises to 725.

Source: psecu.com

Source: psecu.com

HELOCs also resemble credit cards in that borrowers are only required to pay the interest thats due at the end of each statement month. As a HELOC balance fluctuates with user activity and rising or falling interest rates the monthly payments may go up or down. If banks raise the prime to 525 the HELOCs rate rises to 725. Thats the first time in years that Canada saw a widely advertised HELOC rate under prime rate. Tangerine held on to the title of lowest HELOC rate through the COVID-19 lockdown with its rate dipping down to just 235 prime 010.

Source: southstatebank.com

Source: southstatebank.com

If you have good credit your HELOC rate could be around 3 percent to 5 percent. To be sure simply divide the HELOC amount by the value of your home. This rate will never exceed 1590. Again the current prime rate is 325. In early 2020 for example Tangerine emerged as the most competitive SLOC lender in Canada.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

He predicts a 461 percent average rate on home equity lines of credit HELOC for the year and a 505 percent average rate on home equity loans. After the first 12 billing cycles the rate will increase to Prime 375 for lines up to 2499999 Prime 175 for lines between 25000 4999999 Prime 100 for lines between 50000 9999999 and Prime 050 for lines of 100000. As you see in the table above the pricing of a home equity line of credit varies from lender to lender. A home equity line might be advertised as having a rate of prime plus 2 That means when the prime is 5 the HELOCs rate is 7. Rates are available to new accounts only and cannot be used to refinance existing ESL equity debt.

Source: fremontbank.com

Source: fremontbank.com

Home equity line of credit rates are determined by your financial situation and your credit score. The average rate for a variable-rate home equity line of credit is 561. Tangerine held on to the title of lowest HELOC rate through the COVID-19 lockdown with its rate dipping down to just 235 prime 010. The repayment term can be as long as 30 years. He predicts a 461 percent average rate on home equity lines of credit HELOC for the year and a 505 percent average rate on home equity loans.

Source: wesbanco.com

Source: wesbanco.com

The maximum amount of equity you could pull from your home through a HELOC is 105000. The average rate for a 30000 home equity line of credit or HELOC was 6 in December according to Bankrate. The offer carries an interest rate as low as. This rate will never exceed 1590. The interest rate on that hypothetical home equity line would have dropped from 525 to 425 when the US.

The maximum amount of equity you could pull from your home through a HELOC is 105000. Prime plummeted from 425 to todays prime rate. HELOCs also resemble credit cards in that borrowers are only required to pay the interest thats due at the end of each statement month. The offer carries an interest rate as low as. A HELOC on the other hand is more like a credit card in that the interest rate is variable usually indexed to the Prime Rate and the borrower can access as much or as little of a given credit line over the life of the HELOC.

Source: citadelbanking.com

The repayment term can be as long as 30 years. After the first 12 billing cycles the rate will increase to Prime 375 for lines up to 2499999 Prime 175 for lines between 25000 4999999 Prime 100 for lines between 50000 9999999 and Prime 050 for lines of 100000. Home Equity Line of Credit Lock Feature. He predicts a 461 percent average rate on home equity lines of credit HELOC for the year and a 505 percent average rate on home equity loans. A HELOC on the other hand is more like a credit card in that the interest rate is variable usually indexed to the Prime Rate and the borrower can access as much or as little of a given credit line over the life of the HELOC.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title current prime rate for home equity line by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.